The functionality is accessible only if the client has a supplier business transaction available.

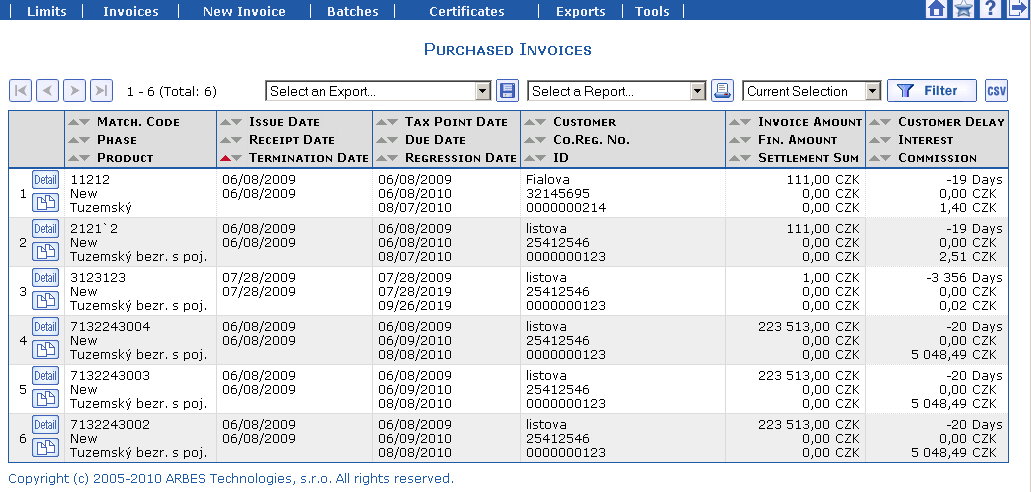

The basic agenda of the eFactoring system is the overview of purchased invoices that clearly displays the list of all your purchased invoices, i.e. the purchased invoices in which your company figures as a supplier.

Overview of Purchased Invoices

The following information is displayed in the overview of purchased invoices:

-

Matching Code – the matching code of the purchased invoice

-

Phase—the status the purchased invoice is in

-

Typed– a new purchased invoice was imported to the factoring company -

Confirmed– a factoring company employee confirmed a new invoice, i.e. a formal check of the essentials was carried out (e.g. whether invoice import took place correctly, whether certain required data is missing on the invoice or whether the invoice contains obviously incorrect information) -

Processed—commissions are generated to the purchased invoice and subsequently the invoice is ready for financing -

Pre-financing– granting an advance for a purchased invoice from the factoring company to your account -

Post-financing– granting additional payment for a purchased invoice from the factoring company to your account -

Guarantee Payment—payment from the factoring company for a purchased invoice to your account if the customer did not pay the invoice and, at the same time, the factoring company took over the obligation to pay the invoice in such a case (in the case of factoring without regression) -

Insurance Payment– this only concerns types of factoring with insurance; a purchased invoice is transferred into this status if it was not paid by the customer and payment (invoice payment to your account) is expected from the insurance company (the external entity stated in the contract)

Final Phases:-

Repurchasing Receivables—if the customer did not send payment to the factoring company account and the guarantee period has expired, the factoring company closes the purchased invoice and issues an invoice to your company for the amount of the given invoice financing provided to you -

Completed with a Claim—this only concerns factoring without regression, i.e. when a factoring company takes over the obligation to pay your company even if the customer does not pay. This is a special case of terminating a purchased invoice, where the customer did not pay the invoice and a claim against the customer was thus created at the factoring company. -

Completed—the completion of a purchased invoice when a customer paid everything on time and the invoice financing provided to you was paid back and none of the three parties (supplier/customer/factoring company) has any claims/liabilities -

Cancelled– the invoice was cancelled but remains in the records

-

-

Product – the factoring type (factoring service) for which you have signed a contract with the factoring company

-

Issue Date, Due Date, Tax Point Date of the purchased invoice

-

Date Received – the date on which the factoring company received the purchased invoice in their records

-

Regression Date – Regressive factoring – if the customer did not paid the liability invoice to the factoring company by this date, the factoring company transfers the purchased invoice back to your company and requires from you a refund of the financing that was not covered by the customer

Guarantee Date – Non-regressive factoring – if the customer did not paid the liability invoice to the factoring company by this date, the factoring company will pay you the guarantee payment (to the amount of purchased invoice or to the amount of purchased invoice decreased by the participation)

-

Customer, Co. Reg. No., Customer ID—information concerning the customer of the purchased invoice

-

Invoice Amount—the currency and total amount including VAT for the purchased invoice

-

Paid Amount – displays the payment amount from the factoring company to your company account for the purchased invoice

-

Settlement Sum Total – the customer settlement sum total

-

Customer Delay – in the case of an unpaid invoice, delay for the entire invoice is displayed in the overview (the difference between the reference date and the due date). The delay for the entire invoice is displayed in the reports in the invoice line. In the case of a paid invoice, the delay at the time of the last customer payment (bank, advice note) which actually paid the invoice or overpaid it (in the case of overpayment) is displayed in the overview. An empty space is displayed in the invoice line in reports

NoteAn invoice is unpaid (as of the reference date) if the invoice amount minus the sum of all customer payments as of reference date is greater than 0.

An invoice is paid (as of the reference date) if the invoice amount minus the sum of all customer payments as of reference date is less than or equal to 0.

In the case of a purchased invoice, the current date (i.e. sysdate) is entered as the reference date.

In the case of an open invoice, a value from the Settlement Date to filter (or the sysdate when no value is entered) is entered as the reference date.

-

Interest – the total amount of all interest that you will pay the factoring company (excluding VAT)

-

Commission – the commission amount that you will pay the factoring company (excluding VAT)

By pressing the  button in the

overview, you create a new invoice into which certain data from the

selected invoice is copied (Customer Name, Product, Currency, Bank

Account Number).

button in the

overview, you create a new invoice into which certain data from the

selected invoice is copied (Customer Name, Product, Currency, Bank

Account Number).

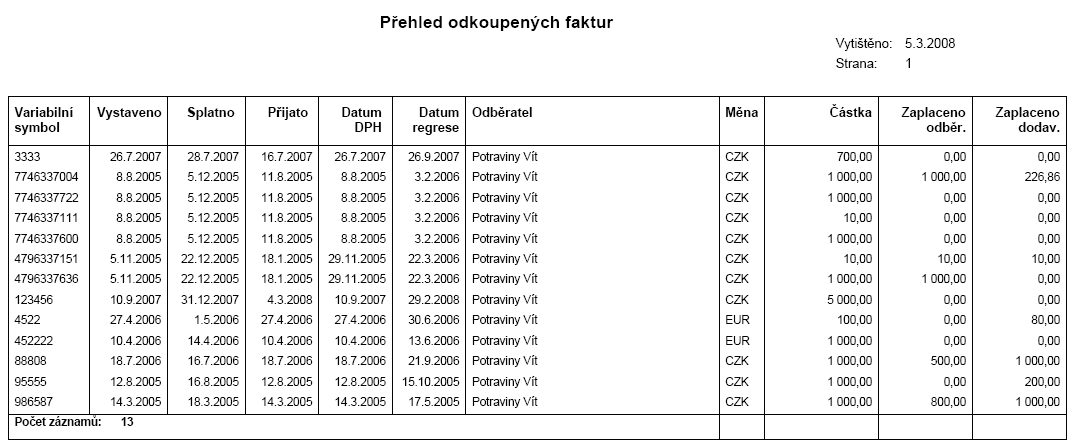

The overview of purchased invoices that you filtered accordingly can be printed using the simple overview of purchased invoices, the overview of purchased invoice settlements grouped by customers, expenses of purchased claims (it displays the commission amounts and the interest for purchased invoices) or the overview of summary expenses.

BBS Export

In the purchased invoice overview, you can export purchased

invoices received from your company into the BBS format (the

Select Export box, specifically FO – Invoices with

Settlements, FS – Open Invoices past Due Date, FT – Open Invoices, FF

– Purchased Invoices). The exported file can be imported into your ERP

system. Purchased invoices can be exported automatically; see the

section BBS Export.

CSV export

Pressing the  button enables the export of

the overview into the CSV format (e.g. for Microsoft Excel).

button enables the export of

the overview into the CSV format (e.g. for Microsoft Excel).

When purchased invoices are exported into a file, the records which appear in the overview of purchased invoices are always exported.

Financing Type Change

By pressing the  button it is possible to carry

out a multiple change to the Financing Type item

on purchased invoices in the overview. The program changes the

Financing Type item on the purchased invoice

according to the setting in the system, i.e. just like if we were

carrying out the change from the purchased invoice form. The

change is only carried out for purchased invoices to which a customer

payment has not yet been sent, which have a category set for

retroactive financing and whose Due

Date is later or equal to the current date. If one of the

purchased invoices does not meet the criteria for changing the

financing type, it is left as is. A list of invoices for which the

financing type has not been changed is displayed in a separate window,

which is called up automatically after the process if carried

out.

button it is possible to carry

out a multiple change to the Financing Type item

on purchased invoices in the overview. The program changes the

Financing Type item on the purchased invoice

according to the setting in the system, i.e. just like if we were

carrying out the change from the purchased invoice form. The

change is only carried out for purchased invoices to which a customer

payment has not yet been sent, which have a category set for

retroactive financing and whose Due

Date is later or equal to the current date. If one of the

purchased invoices does not meet the criteria for changing the

financing type, it is left as is. A list of invoices for which the

financing type has not been changed is displayed in a separate window,

which is called up automatically after the process if carried

out.

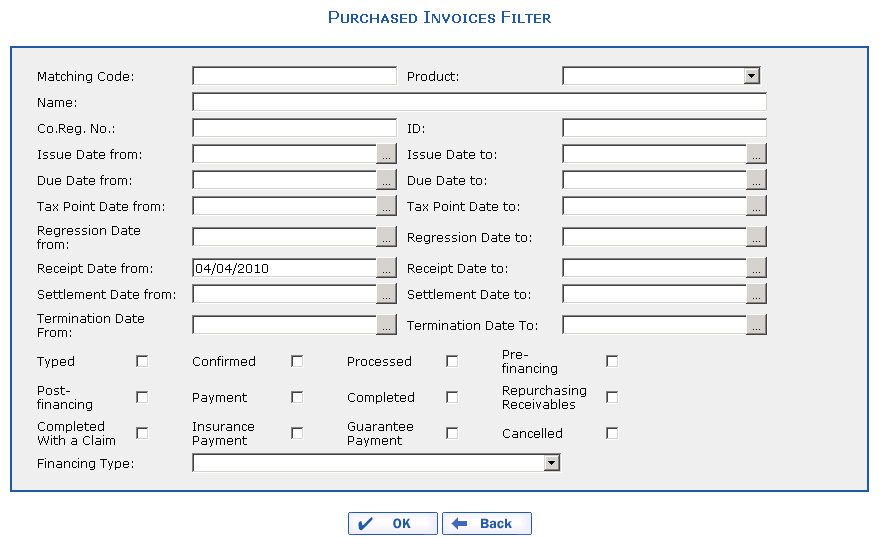

Purchased Invoices Filter

Using the filter of purchased invoices, you can define the selection conditions in such a way so as to display only necessary information, e.g. purchased invoices of one customer (Co. Reg. No.), purchased invoices up to a certain due date (Due Date—to) or purchased invoices in a selected phase.

If the Non-specified filter is selected in the

overview, purchased invoices with an issue date according to the

system settings (e.g. from 1.1.2005) are displayed in the

overview.

In the Financing Type item,

it is possible to select the pre-financing type for which the

purchased invoices should be displayed. If you select the To

reverse financing value, purchased invoices will be

displayed:

-

for which no customer settlement has yet been sent

-

for which the reverse financing category is set

-

for which the Due Date is later than or the same as the current date

Enter the period during which the purchased invoice was completed into the Completion Date from/to item. The purchased invoice completion date is understood as the last date of the transition into one of the possible invoice end phases:

-

Completed (Z)

-

Completed with Claim (W)

-

Repurchasing Receivable (V)

-

Cancelled (X)

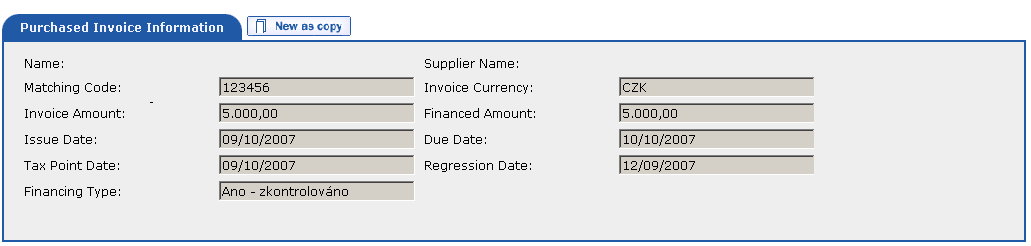

Purchased Invoice Detail

If you click the  icon, the following data

is displayed:

icon, the following data

is displayed:

In the upper part of the dialog, the Purchased Invoice tab is displayed providing detailed information about the purchased invoice (the Matching Code, Invoice Amount, Invoice Currency, Paid Amount, Issue Date, Due Date, Tax Point Date and Regression/Guarantee Date). If you click the Customer Name, the related detailed information is displayed. Clicking the Supplier Name displays detailed information about your company.

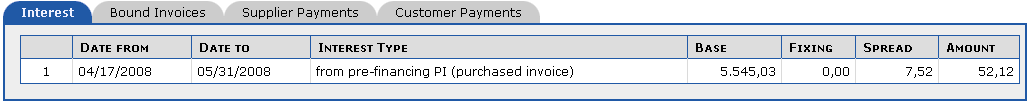

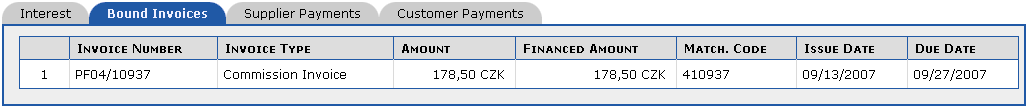

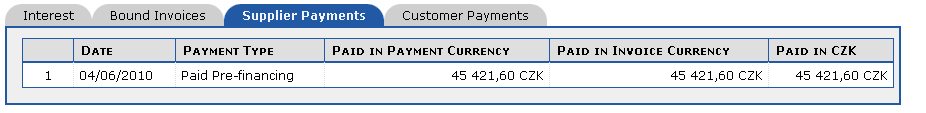

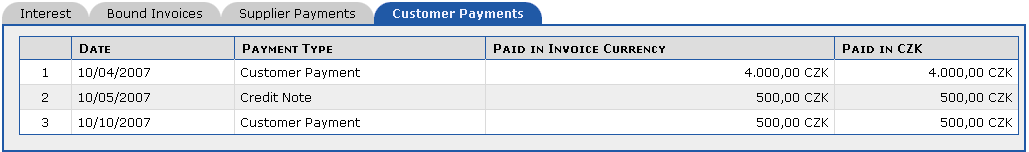

The following tabs appear in the lower part of the dialog: Interest, Bound Invoices, Supplier Payments, Customer Payments.

By pressing the  button in the

purchased invoice detail, you create a new invoice into which

certain data from the selected invoice is copied (Customer Name,

Product, Currency, Bank Account Number).

button in the

purchased invoice detail, you create a new invoice into which

certain data from the selected invoice is copied (Customer Name,

Product, Currency, Bank Account Number).

The following conditions must be met:

-

the factoring company allowed reverse financing to your company and assigned you the corresponding right

-

no customer payment has yet came for the purchased invoice

-

the due date is earlier than or the same as the current date (sysdate)

-

the reverse financing category is set

The  reverse financing button enables you additionally change the purchased

invoice Financing Type item if

you decide that the current purchased invoice financing is unsuitable.

Pursuant to the system parameterization, another invoice financing

category could be selected.

reverse financing button enables you additionally change the purchased

invoice Financing Type item if

you decide that the current purchased invoice financing is unsuitable.

Pursuant to the system parameterization, another invoice financing

category could be selected.

The interest amounts for the purchased invoice are displayed on the Interest tab. The interest represents the price of the credit for the period from when the pre-financing amount was remitted from the factoring company to your account up until the time the customer paid the owed amount.

-

Date from – Date to – the period for which interest is calculated

-

Interest Type – the interest type

-

Base—the amount from which the interest is calculated (e.g. if the factoring company pre-finances an 800 EUR invoice, then 800 EUR is the base for interest calculation)

-

Fixing – maintaining the interest rate level for an agreed-upon period

-

Spread – the fixed percentage rate

-

Amount – the interest amount calculated from the Base for the entered period (the Date from, Date to), yielding interest by the interest rate percentage (which is the sum of the Margin and the Fixing)

On the Bound Invoices

tab, invoices issued are displayed which the factoring company issues

to you and that are bound to a selected purchased invoice. The

Bound Invoices tab displays

invoices whose Invoice Type can

be: Issued Fee, Pre-financing

Overpayment, Pre-financing Overpayment with

Participation, Commission, Interest,

Repurchasing Receivable, Penalty, Liability

Accession Claim, General Bound. For detailed information

concerning issued invoices, see the section Issued Invoices.

The interest invoice amount does not correspond to the given purchased invoice interest amount because each line relates to just one purchased invoice and the interest invoice is the sum of interest of all purchased invoices that yield interest (including the tax point).

On the Supplier Payments tab, payments are displayed which the factoring company made to your account for the purchased invoice. The tab contains the following data:

-

Date – the date on which the payment was made

-

Payment Type – the payment method

-

Paid in Invoice Currency—the amount of the payment in the invoice currency

-

Paid in EUR—the payment amount in EUR

On the Customer Payments tab, payments are displayed which the customer made to the factoring company account for the purchased invoice. The tab contains the following data:

-

Date – the date on which the payment was made

-

Payment Type – the payment method

-

Paid in Invoice Currency—the amount of the payment in the invoice currency

-

Paid in EUR—the payment amount in EUR

Copyright © ARBES, 2019

Overview of Purchased Invoices

Overview of Purchased Invoices Overview of Purchased Invoices

Overview of Purchased Invoices