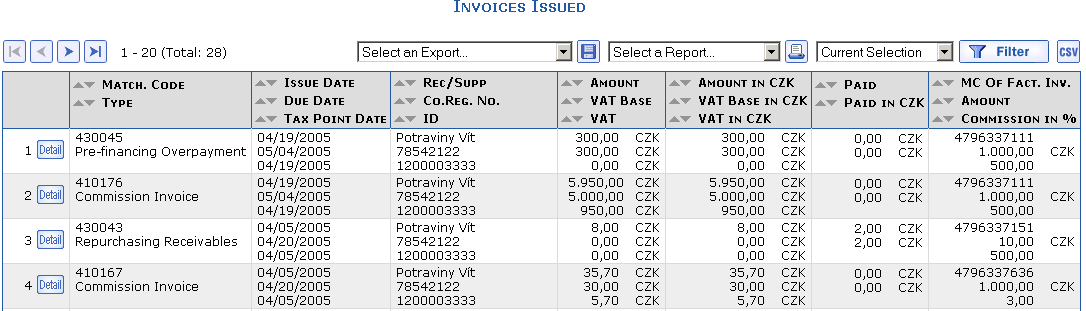

The overview of Invoices Issued displays

invoices which the factoring company issues to you and which are tied

to purchased invoices. Invoices issued for a selected purchased

invoice can be filtered in this overview or you can display them on

the Bound Invoices tab in the

purchased invoice detail. In the overview of invoices issued, invoices

are displayed whose invoice Type

is: Issued Fee Invoice, Pre-financing

Overpayment, Commission,

Interest, Repurchasing Receivables,

Supplier Penalty, Liability Accession Claim and

Generally Bound.

Overview of Invoices Issued

The following information is displayed in the overview of invoices issued:

-

Matching Code – the matching code of the invoice issued

-

Type:

-

Issued Fee—the factoring company issues fee invoices in order to enter various fees related to factoring services -

Pre-financing Overpayment and Pre-financing Overpayment with Participation—the factoring company paid you more financing than would be the financing corresponding to the current invoice amount (a credit note was additionally matched to the invoice) -

Commission– an invoice issued by the factoring company to your company on the basis of the factoring contract that includes the agreed-upon commission for processing a purchased invoice -

Interest– an invoice that relates to purchased invoices and lists the interest levels. Each line relates to one purchased invoice. The interest represents the cost of credit. On an interest invoice, the interest for the pre-financed amount is calculated by the factoring company, i.e. the interest from the time the factoring company remitted pre-financing to your account up until the point at which the customer payment reached the factoring company account. -

Repurchasing Receivables—an invoice issued by the factoring company to your company on the basis of the factoring contract when the financing offered to you exceeds the amount of the given purchased invoice paid by the customer and the regression period is over -

Penalty– the factoring company issues this invoice to your company if it is using it to bill you a penalty fee (supplier penalty) or it issues this invoice for customers as a penalty for an unpaid purchased invoice. -

Liability Accession Claim– an invoice issued by the factoring company based on the liability accession contract. The invoice amount corresponds to the financing the factoring company paid to the supplier. -

Liability fromResignation– invoice issued by the factoring company when you resign from a contract in a discount product. The invoice amount corresponds to the financing not covered by the customer, which the factoring company paid to the supplier. -

Generally Bound– any other invoice

-

-

Issue Date, Due Date, Tax Point Date of the invoice issued

-

Recipient, Co. Reg. No., ID—information concerning the recipient of the invoice issued (the supplier of the purchased invoice)

-

Amount – the total amount of the invoice issued including VAT

-

VAT Base – the total amount of the invoice issued excluding VAT

-

VAT – the VAT of the invoice Issued

-

Amount in CZK—the total amount of the invoice issued including VAT in the domestic currency (CZK)

-

Base in CZK – the total amount of the invoice issued including VAT in the domestic currency (CZK)

-

VAT in CZK – the VAT of the invoice issued in the domestic currency (CZK)

-

Paid—the total paid amount in the invoice currency

-

Paid in CZK – the total amount paid in the domestic currency (CZK)

The other columns are only filled in for the Invoice Type – Commission,

General, Pre-financing Overpayment,

Repurchasing Receivable and Liability Accession

Claim.

-

Purchase Matching Code, Purchase Amount – the matching code and the total amount of the purchased invoice

-

Commission in %—the commission amount in percentage from the purchased invoice which you pay to the factoring company

Export to CSV

Pressing the  button enables the export of

the overview into the CSV format (e.g. for Microsoft Excel).

button enables the export of

the overview into the CSV format (e.g. for Microsoft Excel).

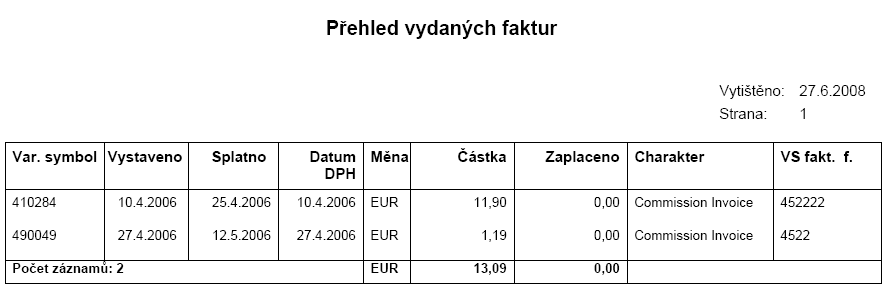

The overview of invoices issued containing the above mentioned items can be printed using the simple overview of invoices issued.

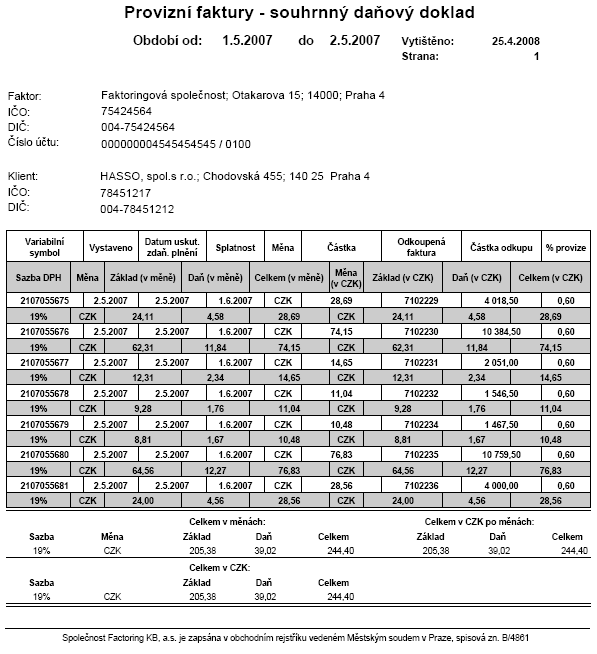

A summary tax document of the commission invoices can be printed using the overview of Summary Commission Invoices or the Summary Commission Invoices by Currency.

The report is always accessible regardless the Invoice Type user filter. If the user has, for example, only interest invoices in the filter, the report is generated empty.

Individual report invoices are listed in ascending order according to the Issue Date and also in descending order according to the Matching Code.

All numerical values are rounded to two decimal places.

The items of the second line are distinguished in color (as in the header) while provisions are made for clear legibility on black and white printing.

BBS Export

In the overview of invoices issued, you can carry out export of

the invoices issued (e.g. commission or interest) issued to you by the

factoring company (the Select Export box, specifically

FP—Commission Invoices, FU—Interest Invoices, FV—Repurchasing

Receivables) into the BBS format. The exported file can be imported

into your ERP system. Invoices issued can be exported automatically;

see the section BBS

Export.

When invoices issued are exported into a file, the records which appears in the overview of invoices issued are always exported.

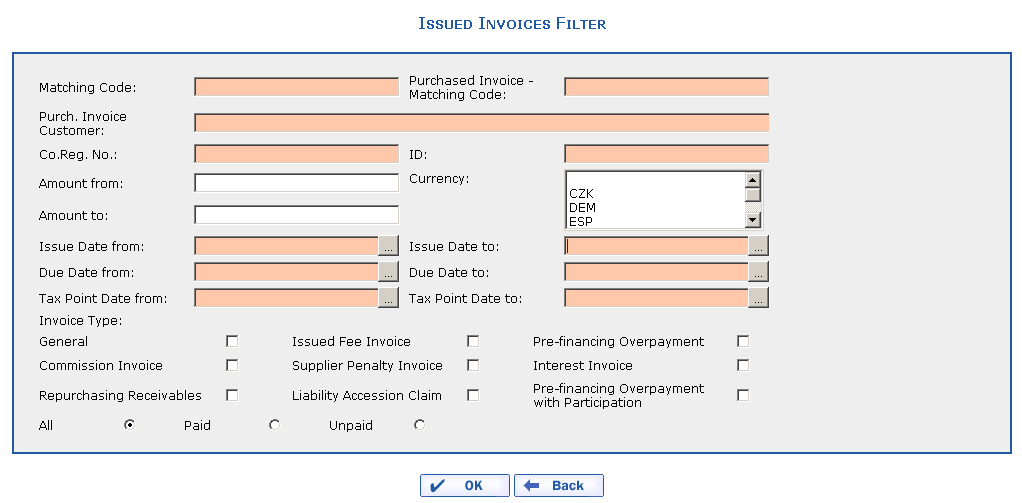

Invoices Issued Filter

Displayed issued invoices can be sorted using the filter, where you enter e.g. the Matching Code of an issued invoice, the Matching Code of a Purchased Invoice, Amount from–to, Invoice Type, etc.

It is possible to select multiple currencies in the Currency field. The selection of several values can be made by holding the Ctrl key and clicking the mouse. The first (empty) button serves for selecting all available currencies.

The invoice issued type can be selected using the multi-selection (check items) as follows:

-

Enabling a relevant field displays the invoices of the given type in the overview of invoices issued as a result group of records.

-

If no check box is enabled, all invoices issued will be displayed in the overview of invoices issued in the result group of records.

-

If all check boxes are enabled, the invoices according to the requested enabled types will be included in the result group of records—this alternative will not necessarily return the same group of records in the future as did the previous selection. That is to say that the functionality depends on:

-

the scope of the defined group of invoices issued displayed in eFactoring.

-

which invoice type check boxes are available in the filter.

-

Now, the functionality will return the same result group of records after enabling or not enabling all fields.

You can further select paid or unpaid invoices. If you select the Paid item, invoices whose Paid amount >= Amount of the invoice issued will be displayed. If you select the Unpaid item, invoices will be displayed whose Paid amount < Amount of the invoice issued.

The * placeholder substituting missing characters can be used when filtering.

The Smart Filter is applied on the agenda of invoices issued according to the system parameterization.

The so-called Smart Filter functionality for the agenda of Issued Invoices has been expanded:

-

The mandatory fields of the Smart Filter are highlighted (in red) in the filter form – the mandatory fields must be filled in using a certain combination, as follows:

-

If no field other than the data field is filled in, the data field interval must fall within the defined interval (1 year by default).

-

If at least one text field is filled in (e.g. the Matching Code field), then fulfilling the interval condition for the data field is not required.

-

Invoice Issued Detail

If you click the  icon, the detail of the

invoice issued with the following data is displayed:

icon, the detail of the

invoice issued with the following data is displayed:

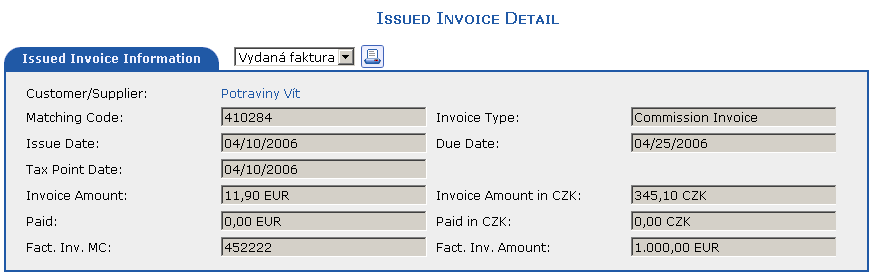

The Invoice Issued—Information tab is displayed in the upper part of the dialog containing general information concerning the invoice issued (the Supplier/Customer, Matching Code, Issue Date, Tax Point Date, Invoice Amount, Paid, Factor. Invoice MC, Invoice Type, Due Date, Invoice Amount in CZK, Paid in CZK and Factor Invoice Amount). If you click the Customer/Supplier, the related detailed information is displayed.

The following tabs appear in the lower part of the dialog: Payments, Interest, Fees and Penalty, according to the invoice issued type.

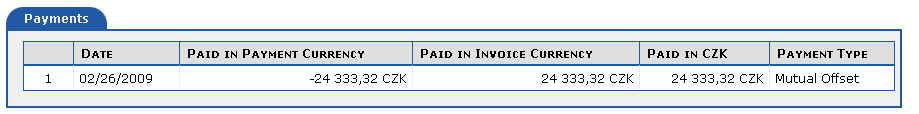

The Payments tab is displayed for all types of invoices issued and displays when and how the invoice issued was settled by the customer/supplier.

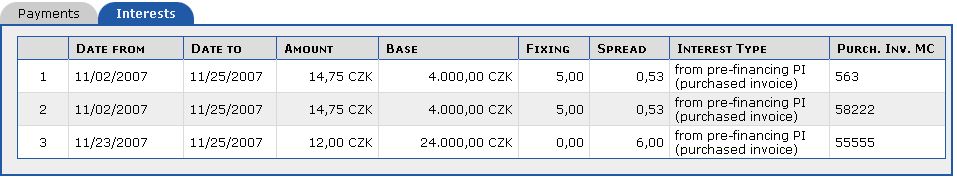

The Interest tab is

displayed only for Invoice Type =

Interest. The tab displays the breakdown of individual

interests of which the invoice is comprised.

-

Date from – Date to – the period for which interest is calculated

-

Interest Type—the interest method

-

Base—the amount from which interest is calculated (e.g. if the factoring company pre-finances an invoice for 800 EUR, then 800 EUR is the base for interest calculation)

-

Fixing—the level (possibly the range) of the interest rate for the agreed-upon period

-

Margin—the fixed percentage rate related to a specific client

-

Amount – the interest amount calculated from the Base for the entered period (the Date from, Date to), yielding interest by the interest rate percentage (which is the sum of the Margin and the Fixing)

-

Purchase MC—the purchased invoice matching code to which the interest relates

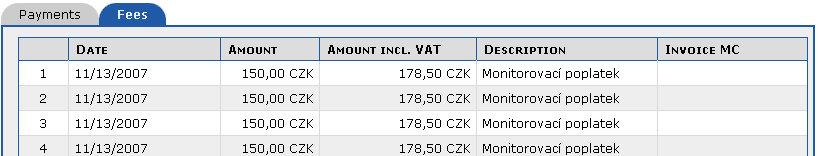

The Fees tab is displayed

only for Invoice Type =

Issued Fee Invoice. The tab displays the breakdown of

individual interests of which the invoice is comprised.

-

Date—the period for which the fee is calculated

-

Amount—the amount of the fee

-

Note—a description of what the fee is invoiced for

-

Purchase MC—the purchased invoice to which the fee relates

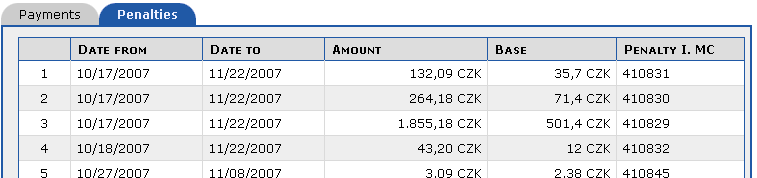

The Penalty tab is

displayed only for Invoice Type =

Supplier Penalty Invoice. The tab displays the

breakdown of individual penalty fees of which the invoice is

comprised.

-

Date from—Date to—the period for which the penalty is calculated

-

Amount—the penalty amount calculated from the Base during the given period (Date from, Date to)

-

Base—the amount from which the penalty is calculated

-

Purchase MC—the purchased invoice to which the penalty is relates

Printing the Invoice Issued Detail

The displayed invoice issued is generated by pressing the

button. It

can be printed or saved.

button. It

can be printed or saved.

Copyright © ARBES, 2019

Overview of Invoices Issued

Overview of Invoices Issued Overview of Invoices Issued

Overview of Invoices Issued