The overview of generated files in the PDF format that are ready for downloading is displayed in the eFactoring application. The files are created on the basis of system parameterization. The exported files are in the PDF format and can be easily saved to the disc or printed.

PDF files can be signed with an electronic signature or a certificate. The factoring company decides whether PDF files will be generated with a signature, i.e. this cannot be modified in the user settings.

The exports can be:

-

for the previous month or the previous day () and are accessible in the overview of PDF Exports provided the system administrator has given you authorization for this export.

-

for the current month from the first day of the month to the current date () which are accessible in the overview of PDF Exports provided the system administrator has given you authorization for this export.

The example below is used to illustrate how to generate manual (ad-hoc) export of invoices issued of the liability accession claim type into the PDF format.

It is presupposed that you have been given authorization for this export. If you do not have access to this type of one-time export, it is necessary to negotiate the relevant conditions with the factoring company. Based on the parameter settings at the factoring company, you will be allowed to generate a relevant file manually.

On 17.10.2008, you would like to have access to all invoices issued of the liability accession claim type.

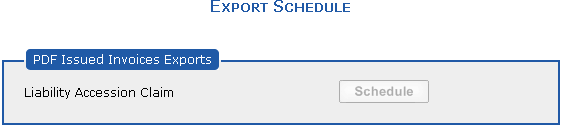

Select the Export Schedule command from the menu.

The Export Schedule overview will be displayed in which you can

see all invoices issued that you can generate manually using the

button.

If the export is scheduled, the command turns grey.

button.

If the export is scheduled, the command turns grey.

The scheduled export of invoices issued of the Commission type will be generated to the second day according to the system settings. It will contain all invoices of this type for which the VAT date falls into the period from 1.10.2008 (the first day of the month) to 17.10.2008 (the export schedule date) that the factoring company has issued to your company. The file will be displayed in the overview of PDF Exports (select the PDF Exports command from the menu).

If an invoice is not a tax document and thus the VAT date is not filled in, its issue date is taken into account. If it falls into the required interval, the non-tax document will be included in the required export.

If you do not want to wait until the next day, you can contact the system administrator at the factoring company who will export the required export for you as soon as possible (depending on how busy the system is).

Copyright © ARBES, 2019

Export Schedule

Export Schedule Export Schedule

Export Schedule