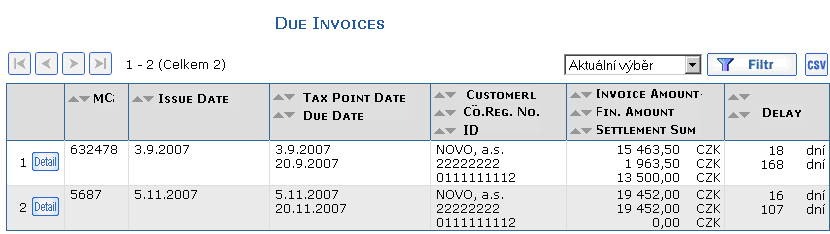

The overview of Due Invoices displays the purchased invoices in which your company figures as a customer (the supplier, with which the factoring company has a factoring contract, submitted an invoice to the factoring company). Here you can find information concerning the amounts that you have not paid to the factoring company for purchased invoices (i.e. only those purchased invoices are displayed in the overview for which the Customer Amount Due is greater than 0).

The following information is displayed in the overview of Due Invoices:

-

Matching Code – the matching code of the purchased invoice

-

Issue Date, Tax Point Date, Due Date of the purchased invoice

-

Supplier, Co. Reg. No., ID—information concerning the supplier of the purchased invoice

-

Invoice Amount—the currency and total amount including VAT for the purchased invoice

-

Customer Amount Due —the amount that your company owes on the purchased invoice (the purchased invoice amount—the sum of customer payments)

-

Settlement Sum Total—the sum total of the amounts that you have already paid for the purchased invoice

-

Payment Term—the difference in days between the Due Date—Issue Date

-

Customer Delay—the difference in days between the Current Date—Due Date if the Current Date <= Due Date 0 is displayed

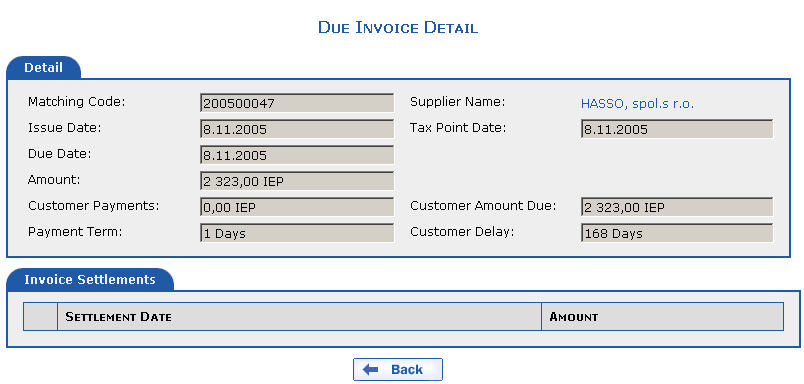

If you click the due invoice  icon, detailed information

concerning the due invoice is displayed (the Matching Code, Issue Date, Due

Date, Tax Point Date,

etc.) along with the up-to-date payment breakdown.

icon, detailed information

concerning the due invoice is displayed (the Matching Code, Issue Date, Due

Date, Tax Point Date,

etc.) along with the up-to-date payment breakdown.

-

Payment Date—the date on which you made the invoice payment

-

Amount—the commission amount that you have paid

Export to CSV

Pressing the  button enables the export of

the overview into the CSV format (e.g. for Microsoft Excel).

button enables the export of

the overview into the CSV format (e.g. for Microsoft Excel).

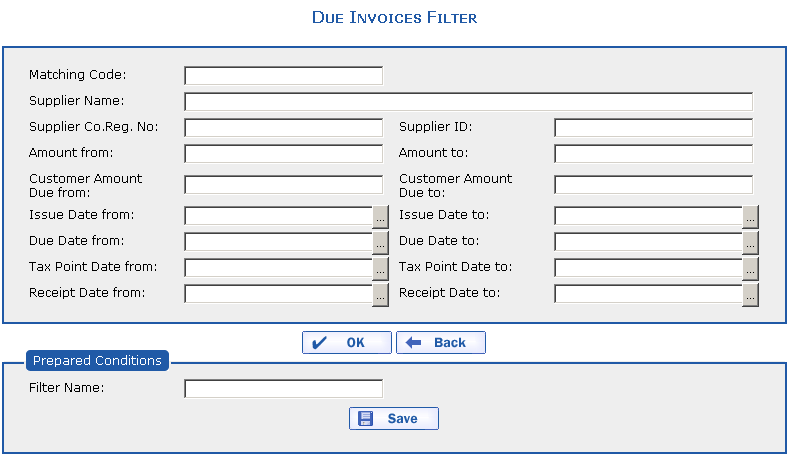

Using the filter of liability invoices, you can define the selection conditions in such a way so as to display only necessary information, e.g. liability invoices of one customer (Co. Reg. No.), liability invoices up to a certain due date (Due Date from – Due Date to).

Copyright © ARBES, 2019

Overview of Due Invoices

Overview of Due Invoices Overview of Due Invoices

Overview of Due Invoices